The 55+ housing market in the U.S. is constantly evolving, with home prices in traditionally affordable age-restricted communities fluctuating and new active adult hotspots emerging. While some markets shift rapidly due to soaring demand, others experience more gradual trends.

In such a dynamic housing landscape, prospective 55+ homebuyers must navigate these changes to find a location that suits both their budget and lifestyle. The process can feel overwhelming, but the real estate experts at 55places.com are here to help. With up-to-date data on 55+ market trends, they can guide homebuyers toward their ideal community with confidence.

We carefully monitor data from the most popular 55+ destinations nationwide to determine where prices are rising and falling. Read the full analysis to stay ahead of the trends and discover the best markets for buying or selling in the 55+ housing sector.

Hot Markets: Where Prices Are Rising

1. Los Angeles Area

Los Angeles is one of the most well-known cities in the United States. Home to Hollywood, Pacific Coast beaches, and world-class attractions, it should come as no surprise that homes in the area remain in high demand, including those in age-restricted communities.

In the last year, the average listing price of homes in 55+ communities in Orange County modestly increased 4.4%, but the average price of a closed home was up 10.6%. Housing costs in the area remain high—the average median listing price falls in the mid $500ks.

Plus, only about 1% of all age-restricted homes in the area are actively listed, limiting options for active adults seeking a home within a 55+ community. This trend indicates that the mix of high demand and low inventory has weakened the buyer’s power when it comes time to negotiate.

2. Southern New Jersey

Southern New Jersey is a popular retirement destination due to its location near major East Coast cities and the state’s tax-friendliness for retirees. The ability to reach metropolises like Washington D.C., New York City, Baltimore, and Philadelphia within a few hours attracts many active adults. Access to beaches along the East Coast is also a great perk.

Consequently, an influx of retirees moving to the area increased closing prices of homes in 55+ communities by 10.7% while the average listing price and average number of current listings have stayed about the same. This resulted in fewer homes closing than in years past, which may be telling of an approaching buyer’s market despite the increased closing prices.

3. Philadelphia Area

The City of Brotherly Love has seen noticeable growth in its suburbs as new residents seek a central location that allows convenient travel to Downtown Philly and the surrounding East Coast. Despite several new 55+ developments in the Philadelphia area, the increase in demand is putting pressure on the 55+ housing market.

The listing price of homes in 55+ communities increased by 8% in the last year, and the closing price of homes increased by 11.3% in the same time frame. Active adults thinking about buying a home in the area can expect to pay slightly more than they would have in years past, and the average number of active listings also dropped by 11.2%, meaning fewer available homes to consider.

4. Knoxville Area

Many imagine Nashville or Memphis when Tennessee comes to mind, but the Knoxville 55+ real estate market has boomed in recent years. It may come as a surprise to learn that Knoxville has the fastest-rising housing prices in the nation as droves of homebuyers seek the bucolic landscape and modern conveniences the city offers.

The 55+ housing market in Knoxville is not immune to the rapid growth and price hikes seen in non-age-restricted housing. The average closing price of homes rose 13.3% in the last year despite the average listing price dropping 2.8%.

The good news is that the number of active listings increased 100% from last year, meaning that prospective 55+ homebuyers now have more choices when searching. Area sellers may be more incentivized to sell when there’s more competition.

5. San Diego Area

Since February 2024, the average closing price of 55+ homes in the San Diego Area increased 15.8% and the average listing price has increased 6.1%, an upward trend that means active adult homebuyers pay more for their home. Nevertheless, many active adults will still choose San Diego as their retirement destination, with one population report projecting that close to one million 60+ adults will be living in the area by 2030.

More and more active adults moving to San Diego may be a good thing for those looking to be surrounded by those with a similar lifestyle. Retirees enjoy Southern California for its pleasant climate, bustling metropolises, expansive parks, and beaches straight out of the movies. Though housing prices in the area have risen, the number of active listings also increased by 54.6%, which may indicate the dawn of a coming buyer’s market.

6. Western Connecticut

Western Connecticut may not hold the same reputation for retirement as destinations like Florida or Arizona, but active adults appreciate the area when seeking to escape crowded East Coast cities like New York City and Boston. Small, comfortable cities like Waterbury, Danbury, and New Haven offer a more peaceful lifestyle desirable for retirement.

The fluctuation of 55+ homebuyers caused both the average listing price and the average closing price to rise 15.4% and 19.1% respectively in the last year. If the market continues to go in this direction, active adults can expect more 55+ communities to appear in Western Connecticut to accommodate the increased population growth.

7. Washington D.C./Baltimore

World-renowned cultural attractions, quality medical facilities, and some of the best museums in the world call Washington, D.C. and Baltimore home, making the area a top choice for retirement on the East Coast. The area’s popularity comes with a price, though—a whopping 20.2% increase in the average closing price of 55+ homes over the last year.

The area saw a 5.4% rise in the average listing price of homes and a 7.3% decrease in the number of active listings. Luckily, the growth in interest for 55+ housing in the area has led to the development of several new 55+ communities with affordable homes.

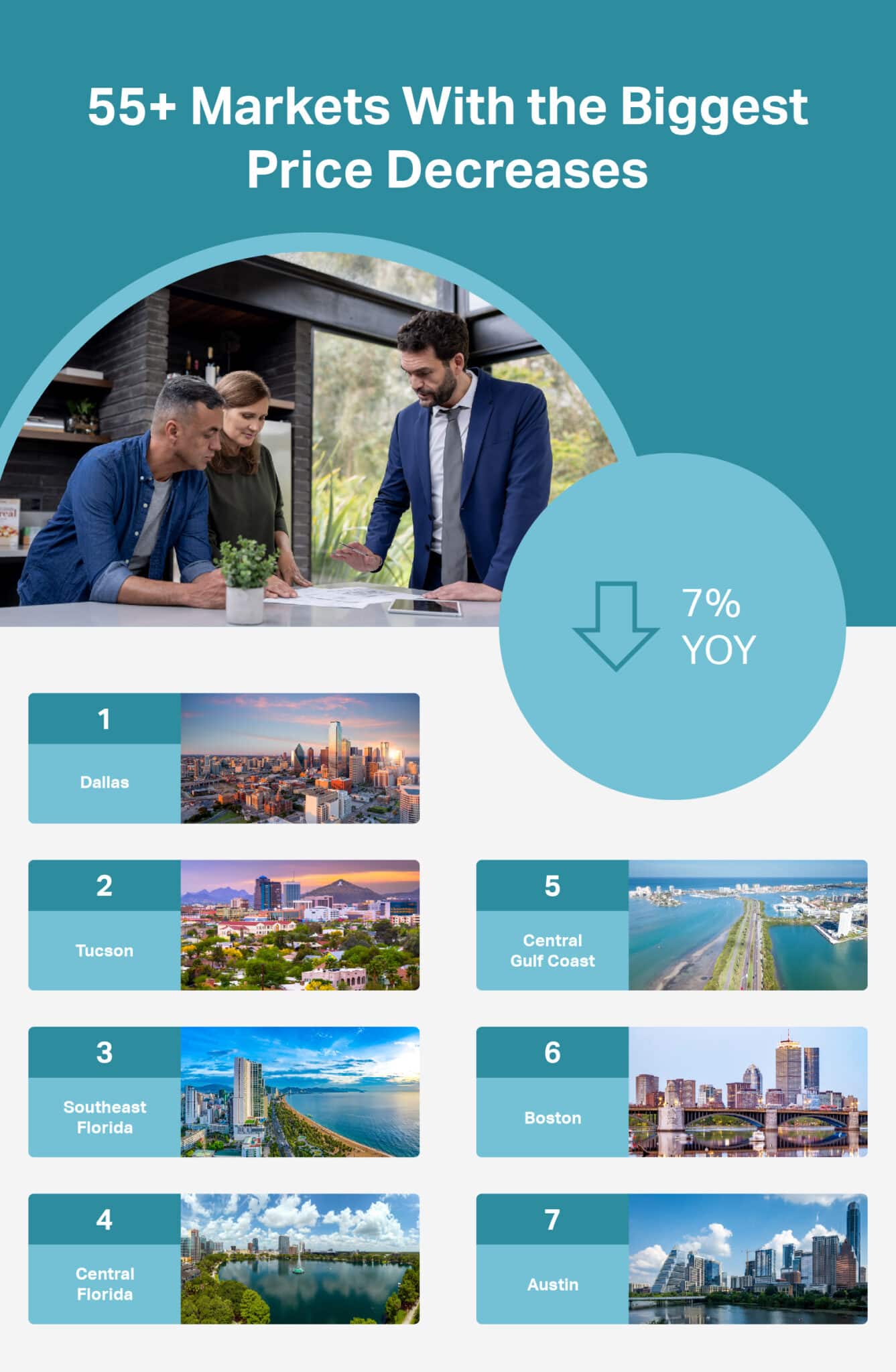

Cooling Markets: Where Prices Are Falling

1. Dallas Area

Active adults looking to take advantage of the warm climate and rich Southern culture of Texas should consider the Dallas/Fort Worth area, especially since the 55+ housing market has cooled off in the last year. The average listing price and closing price of 55+ homes have decreased by about 7%, a change born from a surplus of age-restricted housing in the area.

On average, interested buyers can find more available homes than years prior given that homes do not sell as quickly as they have in the past. These trends indicate that 55+ homebuyers currently hold a little more power in the Dallas area than in other parts of the country.

2. Tucson Area

Arizona is well-known as an active adult hotspot full of massive 55+ communities like Sun City and PebbleCreek near Phoenix. However, Arizona’s second-most populous city, Tucson, is quickly growing as a retirement destination.

The Tucson area has seen a bump in its active adult population as buyers search for affordable homes outside of the Phoenix area. The average 55+ home listing price has dropped by 5.6% and the closing price has decreased by 7.3%, trends that may be connected to the 54.3% increase in active listings this year.

3. Southeast Florida Area

Florida can easily be considered one of the most popular states for retirement. Every year, thousands of active adults flock to the Sunshine State for its tropical climate and tax benefits, which may be part of the reason the 55+ market in Southeast Florida is cooling down.

The oversaturation of the market and rising costs of living have caused a good number of active adults to move away from the area. The 43.9% increase in active listings makes things easier for buyers. Combined with an 11.2% decrease in average closing prices, interested homebuyers may have an easier time locating their dream home in one of the nation’s top retirement destinations.

4. Central Florida Area

Central Florida saw a massive influx in retirees from northern states, partially attributable to the COVID-19 pandemic. Now, the demand for 55+ homes in this area has fallen and made housing cheaper.

Since last year, the average number of active listings has increased 37.1% while the average listing price has dropped 2.4%. The market in previous years had risen to meet the needs of new Floridians, but now, it’s in the process of adjusting as the stream of new homebuyers dwindles.

5. Central Gulf Coast of Florida

Homebuyers interested in Florida’s Central Gulf Coast area can find a desirable mixture of scenic beaches, urban centers like Sarasota, and now lower prices for homes in 55+ communities. Since last year, the closing price of homes dropped 11.5% and the listing price dropped 10.5%, offering an ideal opportunity to find a home in the area.

The cooling market in the Central Gulf Coast area can be attributed in part to the uncertainty surrounding tropical storms and the costs that come with them. After Hurricane Ian, the cost of homeowners’ insurance has risen drastically, leaving many to question living in an area known for hurricanes. This has caused the active number of listings to increase 41.7% from last year.

6. Boston Area

The 55+ housing market in the Boston area has cooled in recent years as the area’s traditionally high costs adjust to more realistic prices that active adults can afford. Though the average closing price of homes has fallen 13.3% in the last year, the average number of active listings has also reduced 14.1%. Though homes may end up slightly cheaper, fewer homes on the market may indicate an approaching seller’s market in which demand raises home prices.

The popularity of the Boston area is no mystery thanks to the city’s rich historical attractions, world-class dining, and high walkability. Despite the high population of Boston and its surrounding area, only about 12,000 homes exist in 55+ communities, another reason why demand is so high.

7. Austin Area

Austin is another retirement destination that saw a massive migration of new homebuyers during the pandemic. During that time, both demand for homes and their prices ballooned rapidly. Now, the regional market has begun to deflate.

Active adults interested in purchasing a home in the area should be interested to learn that the listing price of 55+ homes dropped 5.9%, the closing price dropped 16.3%, and the number of active listings increased 2.9% all in the last year. The average time a home stays on the market has increased from 86 days to 114 days. These telltale signs indicate that active adults can find a buyer’s market in the Austin area.

How to Leverage These Trends for Smart Real Estate Decisions

The knowledge of which markets are rising and falling is only useful to active adult homebuyers who know how to use it. Active adults can and should take advantage of both kinds of markets.

One of the best ways to get more bang for your buck in rising and falling markets is to work with an experienced real estate agent to guide you through the homebuying process. A good agent ensures you pay as little as possible for a desired home and will often deploy several buying tactics to do so.

Buying in a Rising Market

When buying into a seller’s market with rising home prices, homebuyers may think they won’t be able to find an affordable home. This isn’t necessarily the case. Affordable homes can still be found in a high-demand market. Most sellers still expect to negotiate in some capacity.

Sellers may try to overprice their homes if they believe the market is hot, but this doesn’t always work out. Homebuyers should take a look at how long a house has been on the market. If a home has been listed for months with a high price tag, the seller may want to reevaluate and lower the price.

Homebuyers seeking to move into a seller’s market should have a firm understanding of their budget. One way to do this is by getting a pre-approved mortgage, which shows sellers that you are serious and ready to purchase a home as soon as possible. Homebuyers should look at homes listed at or slightly lower than their pre-approved mortgage to maximize their negotiating power on a home they want.

Another way to navigate a rising market is simply to wait for it to cool down. The market constantly shifts for a diverse number of reasons, and a rising market can quickly begin to fall again without warning. If you’ve had your eye on an area with high prices at the moment and you have the time, waiting to see if it starts to trend downwards may be a wise idea.

Buying in a Falling Market

In a falling market, homebuyers hold more power than sellers when it comes time to negotiate a home’s price. Even in areas where the average listing price has increased, it’s possible for the average closing price of a home to still have dropped because the market itself is falling.

Some signs of a falling market include an abundance of actively listed homes, homes remaining on the market for extended periods, and prices being reduced across multiple listings. In this type of market, homebuyers should always offer less than the listing price to bring the price down even further.

Negotiations can also extend past the overall cost of the home. Homebuyers can ask sellers to pay what’s called seller concessions, which can include expenses like closing costs, realtor fees, and repairs on the home itself.

55places.com Can Find the Best Fit for Your Lifestyle and Budget

Current 55+ housing market trends reflect the fluidity of home prices across the country. Prices are falling in traditionally high-demand areas such as Florida, Arizona, Texas, and Boston, while simultaneously rising in growing 55+ destinations like Southern California, the East Coast, and Tennessee.

While the market trends of a given area should be an important consideration for any homebuyer, keep in mind that several important factors should come into play when deciding where one should move. For example, a bump in average home prices shouldn’t exclude an area from your search if it’s somewhere that checks all the other boxes of your ideal lifestyle.

If you’re interested in buying or selling a home in an age-restricted community, knowing the market conditions of the surrounding area can be vital information that saves you a great deal of money. The 55+ real estate experts at 55places.com analyze housing data from around the country and help active adults strategize and find the best fit for their lifestyle and budget.

Methodology

We analyzed data from over 70 Multiple Listing Services (MLSs), focusing on home sales in 2024 and 2025 within the geographic boundaries of more than 2,500 active adult communities listed on 55places.com. Most of these communities are age-restricted for residents 55 and older, in accordance with the Housing for Older Persons Act. We also included a small number of age-targeted communities—those designed to appeal to 55+ residents through their home designs, amenities, and lifestyle offerings, despite lacking formal age restrictions.

For each community, we aggregated key metrics, either summing or averaging values, to reflect trends within the broader “Area” they belong to.

While our methodology provides a comprehensive market overview, it does not account for transactions occurring outside the MLS. This includes many new construction home purchases made directly from builders, as well as private sales between friends or family members. Additionally, we excluded outliers to ensure the data remains relevant to the 55+ homebuying market.